For decades, people considered real estate in India a foolproof path to wealth. Many viewed it as a safe, tangible asset with a guaranteed return. However, a recent discussion on a popular online forum has challenged this traditional belief, painting a picture of a more complex and demanding market. A Reddit user, a professional with two years of experience in the real estate sector, highlights a series of critical mistakes investors make, which lead to surprisingly low returns, often less than 3% annually. This perspective reveals a new reality where success in Indian real estate investment requires more than just capital; it demands strategy, research, and a disciplined approach. The days of effortless wealth creation from property are over.

Debunking Old Myths

The user debunks the most significant misconception: that a property’s value will automatically double in three to five years. This myth, which fueled a generation of investors, simply does not hold true in today’s market. The user points out that even in Tier 1 cities, which people traditionally see as prime investment locations, prices have become stagnant. When you factor in inflation, the real returns are even more dismal. This stagnation, combined with high property costs, means investors often find that the promised quick wealth is an illusion.

Another harsh reality is the poor rental yield in major metropolitan areas. Many investors buy property with the expectation of a steady income stream from rent. However, as the user explains, a flat worth ₹1 crore might yield an annual return of less than 3%. This low return makes it difficult for a rental income to even cover the mortgage EMI, let alone provide a significant profit. This challenge forces investors to rethink their entire strategy, moving away from a passive income model to a more active, business-like management style.

Common Mistakes That Cost Investors

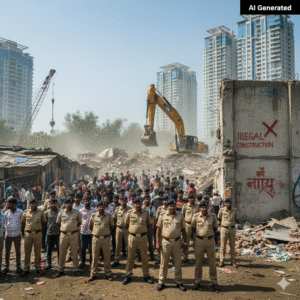

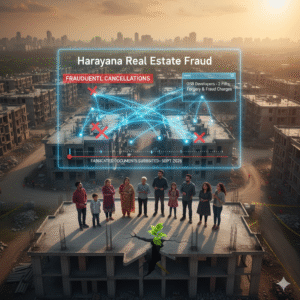

The Reddit user identified several common mistakes that new and seasoned investors alike fall prey to. First, there’s emotional buying. This involves purchasing a property based on sentiment or personal preference rather than sound financial logic. An investor might fall in love with a flat’s view or location and overlook critical factors like the price, return potential, or legal issues. Chasing market hype is another mistake. When a new infrastructure project or development is announced, many people rush to buy property in the area without conducting proper due diligence. This often leads to overpaying and getting caught in a speculative bubble.

Furthermore, a lack of due diligence is a major pitfall. The user emphasizes the importance of thorough legal checks and data-backed research. Many investors skip this crucial step, relying on a developer’s reputation or a broker’s word. This negligence can expose them to legal disputes, project delays, or even outright fraud. In the new era of Indian real estate investment, ignorance is no longer bliss; it’s a financial liability.

A New Path to Success

The user suggests a new approach for success in today’s market. Instead of focusing on oversaturated Tier 1 cities, investors should look to Tier 2 cities and emerging markets. These areas often have lower entry costs and a greater potential for value appreciation as infrastructure and job opportunities develop.

The need for a business-like approach is also critical. Real estate is no longer a passive “set it and forget it” investment. It lacks liquidity and requires active management to ensure a good return. This means being prepared for maintenance costs, tenant management, and a long-term holding period. Success in Indian real estate investment requires patience, clarity on financial goals, and disciplined planning. It’s a game of foresight, not a quick gamble. The old assumptions of guaranteed wealth are fading away, replaced by a more sober, strategic reality. This shift requires a new mindset for anyone looking to build wealth through property in India.

Source – ET