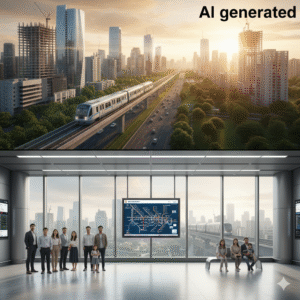

India’s real estate market is experiencing a significant boom, but this growth is creating a paradox: while gleaming new towers are rising across the country’s metropolitan cities, many Indians are finding it increasingly difficult to afford a home. Financial influencer Sharan Hegde has brought this issue to the forefront, exposing what he calls a “ghost tower” economy.

Hegde argues that the real estate boom is fueled by speculative investors rather than genuine homebuyers. In cities like Mumbai and Gurgaon, ultra-luxury apartments are being sold at exorbitant prices, often as second or third homes for the wealthy. The result is a landscape of “ghost towers” – opulent buildings with low occupancy rates, where homes are treated as assets rather than places to live. This trend is pricing the middle class out of the market, making the dream of homeownership an increasingly distant one.

Price Boom

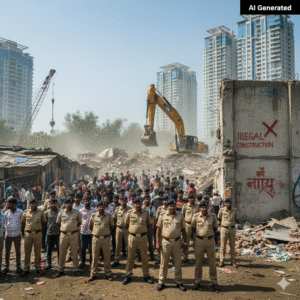

Even in Hyderabad, a city once known for its relative affordability, the real estate market is showing signs of cooling down. Inflated prices, driven by a fear of missing out (FOMO) and easy credit, led to a construction frenzy. Now, with a surplus of properties and a collapse in demand, resale prices in some areas have plummeted by 15-30%.

To address this speculative spiral, Hegde proposes several measures, including a vacancy tax on homes left unoccupied for over a year, mandatory annual occupancy declarations, and higher stamp duties for investor-owned properties. He also suggests that authorities should cap new projects in oversupplied areas and implement minimum holding periods with steep taxes on quick resales. According to Hegde, the focus should be on building homes for people, not creating “hollow assets” for investors.

Source:- BT