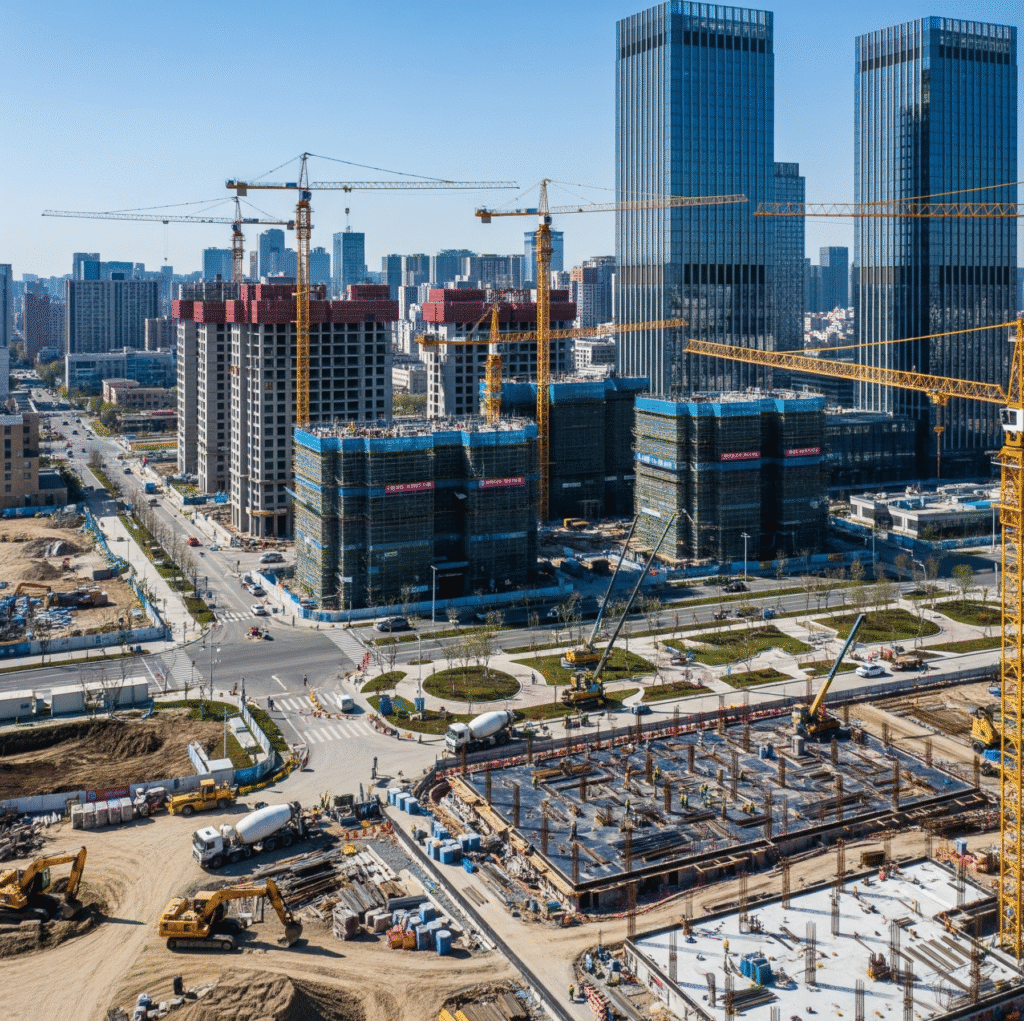

In a landmark transaction that underscores the continued dynamism of the National Capital Region’s (NCR) real estate market, Signature Global, a frontrunner in the Indian property development sector, has cemented its future growth trajectory with a significant Gurugram land acquisition. The company has announced the purchase of a 33.47-acre land parcel located in the strategically important Sohna region of Gurugram for approximately ₹450 crore. This strategic move, executed through three separate sale deeds, is a clear signal of the developer’s confidence in the area’s potential and its commitment to meeting the escalating demand for quality housing projects.

The Sohna region has emerged as a key destination for both residential and commercial development, buoyed by improving infrastructure, enhanced connectivity, and its proximity to Gurugram’s bustling economic hubs. For Signature Global, which has its roots in Gurugram, this particular Gurugram land acquisition is not just an expansion of its land bank but a reinforcement of its home-ground advantage. The company, which was recently recognized as the fifth-largest player in terms of pre-sales in the last fiscal year, has demonstrated a remarkable ability to deliver and sell projects successfully. Its impressive sales figure of ₹10,290 crore last year highlights its market leadership and the trust it has built with homebuyers and investors.

The newly acquired land parcel offers a substantial development potential of around 18 lakh square feet, providing a fertile ground for the company to launch a new wave of residential offerings. This deal is part of a larger, more aggressive expansion strategy. As per company chairman Pradeep Kumar Aggarwal, the firm plans to invest between ₹1,200 and ₹1,500 crore in land acquisitions during the current fiscal year (2025-26), a significant increase from the ₹1,070 crore invested in the previous fiscal year. This sustained focus on land banking indicates that Signature Global is proactively securing prime locations to fuel a robust pipeline of future projects, with a keen eye on high-growth corridors not just in Gurugram but across the Delhi-NCR region, including Noida and Greater Noida.

The broader implications of this Gurugram land acquisition are substantial. For potential homebuyers, it means the introduction of new, thoughtfully planned housing projects in a developing area. For the local real estate market, it injects a fresh wave of investment and development, which can lead to job creation and further infrastructural improvements. The transaction also reflects a growing trend among leading developers to shift focus towards mid-income and premium housing segments, driven by rising disposable incomes and changing consumer preferences. While the market for luxury homes (priced above ₹5 crore) remains steady, a noticeable gap exists in the ₹2-5 crore bracket, which Signature Global’s new projects are likely to address. By strategically acquiring land with a large development potential, the company is positioning itself to capitalize on this market dynamic. The company’s confidence is further reinforced by its ambitious pre-sales guidance of ₹12,500 crore for the current fiscal year, a target that seems well within reach given its aggressive acquisition strategy and strong market presence. This Gurugram land acquisition is a powerful testament to Signature Global’s strategic foresight and its pivotal role in shaping the future of real estate in the region.

Source : ET