Gurugram’s real estate market has long been synonymous with luxury properties and high-end developments. However, a recent analysis from a real estate advisor suggests that the most lucrative investment opportunities may not be found in the city’s well-known luxury corridors. In fact, investors who continue to focus on “branded assets” might be missing out on a “10X opportunity” that is quietly emerging in the suburban fringes of Gurugram.

The Saturation of the Luxury Market

According to real estate advisor Aishwarya Shri Kapoor, the luxury real estate market in Gurugram is showing signs of saturation. In a pointed critique, she highlighted that margins in the luxury segment are shrinking, and resale volumes are beginning to slow down. This trend is leading institutional buyers to explore areas that have been largely ignored by retail investors. The prevailing myth that “branding equals alpha” in the real estate market is now being challenged by the data emerging from Gurugram’s suburban areas. While locations like Golf Course Road and properties such as “The Camellias” continue to attract attention, the real story of wealth creation is unfolding elsewhere.

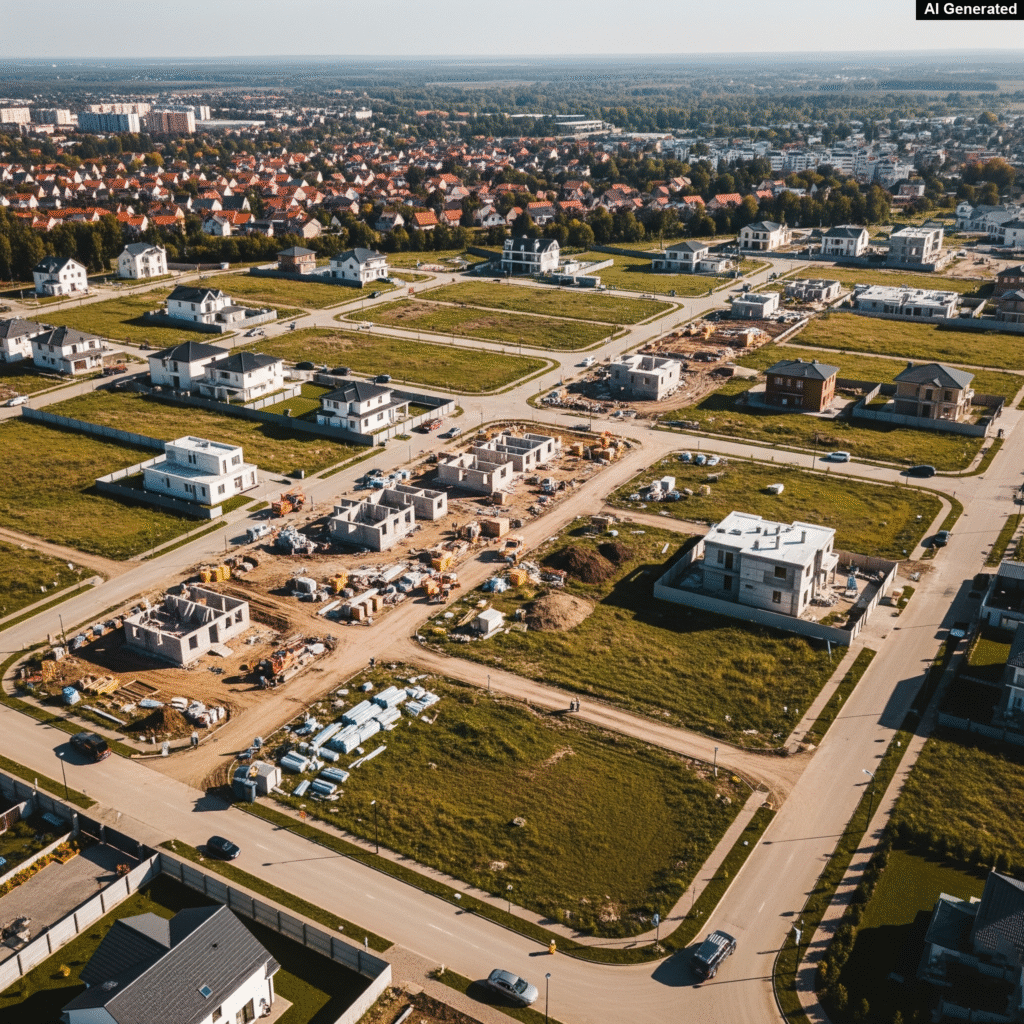

The Untapped Potential of Suburban Gurugram

Kapoor’s analysis shines a spotlight on the often-overlooked suburban stretches along NH-48, the Southern Peripheral Road (SPR), and Dwarka Expressway Phase II. These are the areas where the next wave of growth is expected. The data supports this claim, with impressive appreciation in property values. For instance, Sectors 92-95 have seen a price appreciation of 28-34% since 2020. In Sectors 76-79, the value of plots has surged from ₹65,000 to ₹1.1 lakh per square yard in just three years. Furthermore, in the 2023-24 period, flats under ₹1 crore have outperformed ₹10 crore branded assets in terms of return on investment (ROI). The announcement of major infrastructure projects like the UER-2 and Global City has also triggered a sharp rally in these emerging micro-markets.

A New Investment Paradigm

This shift in the market calls for a new investment strategy. Kapoor advises investors to bet on areas where infrastructure is planned but not yet completed. The focus should be on government approvals rather than glossy branding. The key is to enter the market early when there is still uncertainty but the fundamentals are strong. The time to exit is when the “brochure gets glossy and influencers show up.” This approach is not new; it’s a cycle. Today’s undervalued plots are reminiscent of Golf Course Road in 2008, which was once just a “dusty brochure,” or DLF Phase 5, which was initially dismissed as being “too far.”

In conclusion, while the allure of luxury real estate in Gurugram remains strong, the smartest investors are those who can spot undervalued land before the infrastructure and marketing blitz arrives. The path to significant gains is not always the most glamorous one. As Kapoor aptly puts it, these emerging areas are “not sexy. It’s not on billboards. But it’s where the next ₹100 crore builders are getting created quietly.”

Source – BT