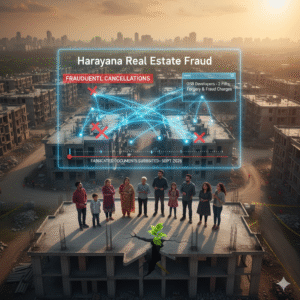

The real estate landscape in Gurgaon is undergoing a seismic shift, with property prices soaring to unprecedented highs. This dramatic escalation is largely attributed to a significant influx of capital from returning Non-Resident Indians (NRIs) who are choosing to invest their overseas earnings in the Indian housing market. This trend is creating a challenging and often insurmountable barrier for first-time homebuyers and middle-class families who lack generational wealth or a hefty overseas income.

A recent online post on Reddit from a returning NRI opened up a floodgate of discussion, with many users directly pointing to the return of NRIs as the primary driver behind the market frenzy. These individuals, often compelled to return to India due to reasons like visa complications or tech-sector layoffs in the US, are parking their substantial savings into real estate, which is seen as a secure and lucrative investment. This significant injection of foreign currency is not only driving up property costs but also benefiting a select group of investors, while simultaneously squeezing out locals and other prospective homebuyers. The discussion on the platform highlighted that this issue is not exclusive to Gurgaon, with other major Tier 1 cities like Hyderabad and Bengaluru experiencing a similar, if not identical, phenomenon of grossly inflated real estate values. Experts in the field have issued a stern warning, suggesting that if this trend of speculative demand persists without a corresponding and substantial increase in housing supply, it could ultimately lead to an entire generation being locked out of the housing market.

Source :- BT