Despite the ongoing real estate boom in major metropolitan areas, a significant undercurrent of caution persists. Developers are competing to offer world-class amenities—from five-star hotel-like facilities to cutting-edge architectural designs. But this growth is not without its challenges. The biggest concern for buyers isn’t the lack of luxury. It is the lingering trust deficit. Past project delays, regulatory ambiguities, and broken promises have created this problem. Experts say this lack of trust is the single greatest hurdle to the sector’s long-term stability and future potential.

Cities like Gurgaon and regions along the Dwarka Expressway are preparing for massive new infrastructure projects. The demand for high-end residential and commercial properties is soaring. Real estate has transitioned from a mere lifestyle choice into a robust investment avenue, attracting both domestic and global capital. However, this growth has been consistently undermined by a history of weak contract enforcement. An unpredictable regulatory environment is another major issue. Many buyers and developers are entangled in prolonged legal disputes. Some of these cases have even reached the Supreme Court. These conflicts have eroded public confidence, making even the most attractive-looking projects a source of anxiety.

The Trust Deficit and The Critical Need for Legal Certainty in Real Estate

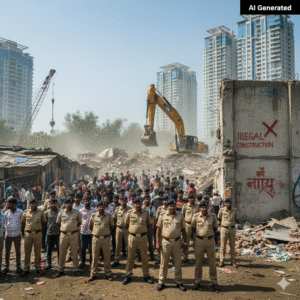

For years, the Indian property market has struggled to improve its reputation. It has often been seen as a risky landscape for investment. The primary culprits have been inconsistent policy enforcement at the state level. Sudden regulatory shifts and a lack of accountability from developers also contribute to the problem. These issues have not only frustrated individual homebuyers waiting for their homes. They have also discouraged large-scale foreign and domestic capital. Investors prioritize security over speculative gains.

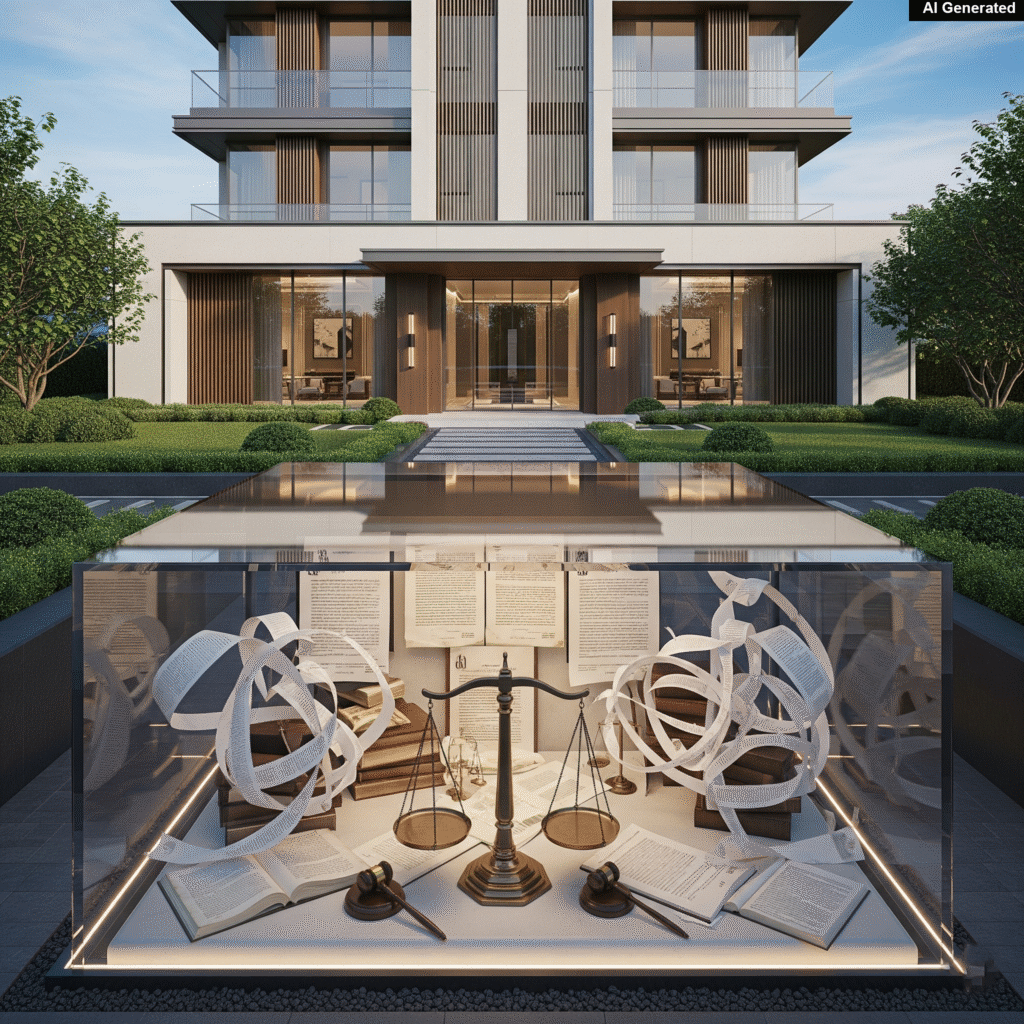

The perception of risk has been a major deterrent. A strong and predictable legal framework is missing. This creates an environment of uncertainty. Investors fear their capital could get trapped in contractual disputes or endless project delays. This is particularly true for high-net-worth individuals and institutional investors. They need a clear and stable legal foundation before they commit significant funds. The message is clear: profit is a motivator, but the security of one’s investment is a top priority.

Key Reforms and the Road Ahead

In recent years, the government has taken significant steps to address these systemic issues. The Real Estate (Regulation and Development) Act (RERA) was a landmark reform. It brought much-needed transparency and accountability to the sector. RERA’s provisions are helpful. They include mandatory project registration, timely disclosures, and a dedicated grievance redressal system. These have helped restore a sense of order. Moreover, amendments to bankruptcy laws and active judicial intervention have strengthened the rights of buyers.

Despite these positive developments, the real challenge lies in consistent enforcement. According to legal expert Venkat Rao, founder of Integrate Law, “While reforms like RERA and landmark Supreme Court judgments have bolstered confidence, the true challenge lies in consistent enforcement.” He adds that a predictable legal framework assures investors their money won’t be entangled in regulatory ambiguities. This assurance serves as a bridge, connecting developers, homebuyers, and investors. This concept is fundamental to achieving Legal Certainty in Real Estate.

The real estate sector is at a crossroads. Its future success will be measured by the strength of its legal and regulatory foundations. It’s not just about the height of its skyscrapers or the luxury of its amenities. The ongoing infrastructure boom provides an undeniable opportunity for growth. However, to transform from a speculative market into a secure investment haven, the industry must continue to build on trust. This means ensuring rules are stable, contracts are honored, and disputes are resolved efficiently. This dual protection of consumer interests and investor capital will drive a sustainable revival in the property market.

Source – News18