Ever feel like everyone’s a real estate expert? With the market in India booming, it’s easy to get caught up in the hype. But what if your “dream investment” turns out to be a nightmare? A leading real estate advisor recently shared some vital warnings about the risks that many Indian property investors fall into. Don’t let these common mistakes cost you your hard-earned money.

Here’s a breakdown of the four biggest traps to watch out for.

Trap #1: The All-Cash Buy

While it might seem like a smart, debt-free move, buying a property with 100% cash can be a mistake. Why? Because you’re missing out on a powerful tool: leverage. A home loan allows you to use a smaller portion of your own capital while controlling a much larger asset.

Think about it this way: instead of tying up all your savings in one property, you could use a loan for your first purchase and invest the remaining funds in other assets like stocks or mutual funds. This diversification helps mitigate risk and can give you a better overall return. The key is to manage your debt wisely.

Trap #2: Getting Emotional

Buying a property is a huge life event, and it’s easy to let emotions take over. You might fall in love with a specific apartment or villa, ignoring crucial financial details. But remember, an investment is a business decision. You need to look at the numbers, not just the “feel” of the place.

Always ask:

- Is the price fair for this location?

- What’s the rental yield?

- How long will it take to break even?

Making a data-driven decision is what separates a smart investor from someone who just bought a costly house.

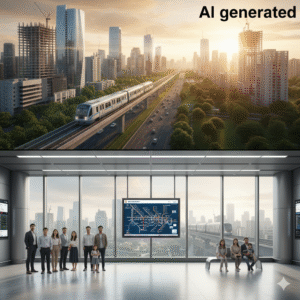

Trap #3: Focusing Only on Capital Appreciation

Many investors in India buy a property hoping its value will skyrocket in a few years. While this capital appreciation is a key benefit, it shouldn’t be your only goal. What if the market stagnates or drops? You need a safety net.

Smart investors also prioritize rental yield—the income you earn from tenants. A good rental yield provides a steady cash flow and acts as a buffer against market fluctuations. It can also help cover your EMI, making the investment self-sustaining. Look for properties in locations with high rental demand to ensure a reliable income stream.

Trap #4: Blindly Trusting Everyone

In the world of real estate, advice is everywhere. From family members to friends and online gurus, everyone has an opinion. While some advice is well-intentioned, it may not be right for your specific financial situation.

The article stresses the importance of doing your own research and, more importantly, seeking guidance from a qualified, experienced real estate advisor who has no vested interest in a specific property. Their job is to help you, not to sell you a product.

Source :- BT