The Delhi-National Capital Region (NCR) is experiencing an unprecedented boom in its luxury real estate sector, with branded residences at the forefront of this growth. This surge is creating a dynamic investment landscape where high-end properties are not only offering exceptional living experiences but also delivering impressive returns.

Recent data from a Savills India report highlights this trend, showing a 9% year-on-year increase in the value of luxury floors in Delhi-NCR during the first half of 2025. Residential plots also saw a healthy 7% rise, signaling robust market confidence.

Key Drivers Behind the Growth - Real Estate Investment

The factors fueling this expansion are multifaceted, driven by a combination of infrastructure development and a shifting economic landscape.

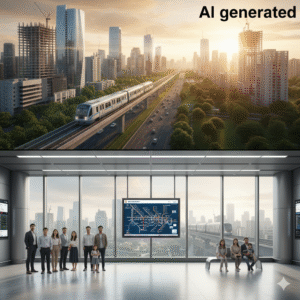

- Infrastructure Revolution: Major projects like the Delhi-Meerut RRTS and the Dwarka Expressway have dramatically improved connectivity, making luxury properties in once-remote areas more accessible and desirable.

- Favorable Economic Conditions: A decrease in retail inflation to 2.8% and a reduction in the RBI’s repo rate to 5.50% are making borrowing more affordable, which in turn, is encouraging more buyers to invest in high-ticket properties.

The Rise of Experience-First Living

Experts are noting a fundamental shift in what buyers are looking for. Today’s luxury homebuyers aren’t just purchasing a house; they’re investing in a lifestyle. According to Sudeep Bhatt of Whiteland Corporation, buyers now prioritize homes that offer well-being and a superior lifestyle, moving beyond the traditional focus on physical space alone.

This has led to the rise of branded residences, which provide five-star services and exclusive amenities combined with the privacy of private ownership. These properties are often associated with renowned international brands, guaranteeing a standard of quality and luxury that commands a premium.

Proven Success and Impressive Returns

The returns on these properties speak for themselves. The article highlights the success of projects like Trump Tower 1 in Gurugram, which saw its per-square-foot price jump from Rs 13,500 at launch to Rs 40,000 today—a remarkable 2-3x increase. Following this success, the launch of a second Trump-branded residence sold out on the first day, generating a staggering Rs 3,250 crores, with many buyers being repeat investors.

Similarly, DLF real estate investment has achieved extraordinary success with its ultra-luxury projects. A 16,290 sq ft penthouse at The Camellias sold for a record-breaking Rs 190 crore, while its project, The Dahlias, sold all 173 units at an average price of Rs 70 crore each.

A Structural Shift in the Market

Industry leaders like Sumit Chaudhary of Elan Group and Sam Chopra of eXp Realty India agree that this trend represents a “structural shift” in the market. Branded residences are outperforming traditional real estate, solidifying their position as the new investment hotspot. Buyers are seeking “experience-first living,” and developers who can deliver on this promise are reaping the rewards.

Source: FE